Have more questions?

Frequently Asked Questions

What is a share?

When you buy a share you are buying a small piece of a company. Like a house, the more bricks you own the more of the house you own.

How much is a share?

Each HCB share will be sold at a price of 3 Meticais

How do I know if I can buy shares?

You qualify if you are a:

- Mozambican national (individual investor)

- Mozambican national and work for HCB (HCB employee)

- Mozambican/national pension fund whose investments come from contributions of Mozambican nationals (collective national corporate investor)

- Mozambican/national social security institution (collective national corporate investor)

- Mozambican/national institution (collective national corporate investor)

- Company constituted and registered in Mozambique, wherein Mozambican national individual investors or Mozambican institutions or companies owned by the State or any combination of these hold more than 50% of the share capital

When can I start buying shares in HCB?

- The first order period will run from 08h00 on 17 June 2019 and end at 8h00 on 1 July 2019 (inclusive)

- The second order period will run from 08h00 on 1 July 2019 (exclusive) and end at 17h00 on 12 July 2019

Where can I buy HCB shares?

At the following branches (and via the relevant internet banking platforms):

BancABC

Banco Único

Barclays

BIM

BNI

Capital Bank

Eco Bank

FNB

MOZA Banco

Standard Bank

You can also purchase shares via BCI’s remote channels:

- USSD mobile application

Dial (*224 #) free of charge, accessible from any device with a valid and active SIM card from Vodacom, TMCEL or Movitel (only for segments A, B and C)

- BCI Trading mobile app (only for segments A, B and C) – accessible from any tablet or smartphone running on Android of iOS

Data costs will vary, depending on service provider.

What information do I need to provide to place an order and buy shares in HCB?

For Mozambican nationals (individual investors) who place an order via remote channels:

- Name

- Province and district of residence

- ID or passport number

- Bank account details where you want to receive dividends or M-Pesa account, e-Mola account, mobile account

- NUIT (Unique Tax Identification Number)

If you do not have a bank account, you will have a maximum of 6 months from the date of share allocation to verify the above. Those with bank accounts at other banks could be asked to update personal details. Mozambican companies will need to present documents (including an affidavit and updated commercial registry certificate) that prove compliance or eligibility. These should be presented in no more than 30 days after notice.

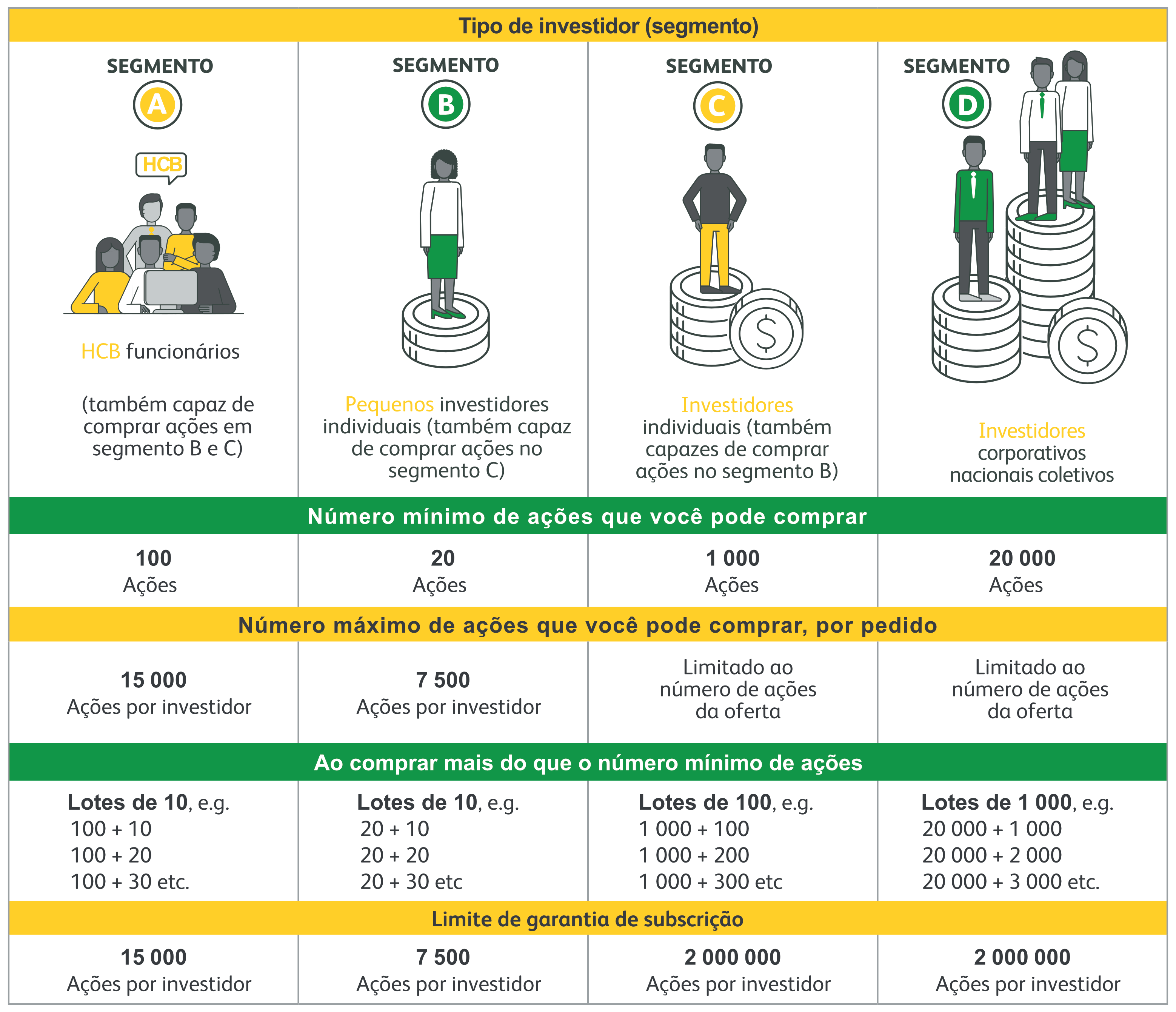

How many shares in HCB can I buy?

How do I pay for the shares I buy?

Pay for your shares directly after placing your order

BCI account holders will be directly debited at the end of Phase B

Non BCI account holders can pay via:

- Alternative bank accounts (at branches, ATMs or through internet banking)

- M-Pesa account

- e-Mola account

Mobile account *124#

When do I pay for the shares?

You can pay after placing your order. However, if payment is not received before the end of the order period (12 July 2019), the order will not be processed.

What costs/fees will be charged?

You will be charged fees by the financial intermediary through which you place your order (unless these are exempted or returned, as in the case of segment B ), as well as by the stock exchange (BVM) and the Securities Exchange Commission (CVM).

The following charges can be expected:

- Brokerage commission

- Commission for processing the order of subscription by the financial intermediary taking the order

- Other charges that may be charged by the financial intermediary taking the order

- The stock exchange rate (0.10% on the selling price of the share x the

number of shares purchased)

- Registration fee due to the CVM (0.20% on the selling price x the number of shares purchased)

- Small investors (segment B) will be exempt from some or all of these fees

Income from the ownership of shares will be taxed at a rate of 10% for investors subject to income tax in Mozambique

When will I know whether my order has been approved?

The results of the allocation of shares should be available within three business days following the end of the offer period, possibly on 17 July 2019. The results of the offer will be published in the Bulletin of Quotations of the Stock Exchange of Mozambique, as well as in newspapers.

What happens if I am not allocated the shares I requested/applied for in the Subscription Order?

Ownership transfer of the shares will take place approximately 12 business days after 17 July 2019 (the date on which the results of the allocation are announced). This is called the settlement date. If you don’t get the shares you applied for (if registration of all requested shares is not possible) then your money will be refunded to the account provided upon registration (if purchased through traditional banking channels, funds will be unblocked).This may take up to 12 additional business days from the settlement date if the order was placed via a remote channel.

When will the shares be mine?

The shares will become yours when all of the following requirements have been met:

- The eligibility requirement

- KYC requirements

- Payment has been received for the shares and costs, like fees and commission (if applicable)

- Physical settlement of the shares has been completed

What proof do I receive that I own shares?

You can request a declaration or certificate from the financial intermediary where the order was placed.

What is the cost of holding shares?

Costs will include:

- A securities custody commission

- A dividend processing commission (when and if a dividend is paid by HCB)

When will dividends be paid?

HCB will pay dividends annually (unless otherwise stipulated), following the closure of its financial year, which is 31 December and the approval of its accounts by the External Assembly (this typically takes place in May each year). Profits made during the course of the year will be placed in a reserve fund and will be distributed to shareholders as dividends per share. At least 25% of the distributable profit for the year will potentially be paid in dividends.

How will dividends be paid and in what currency?

Dividends will be paid into the account provided during registration and will be paid in Meticals.

What does being a shareholder in HCB mean?

Being a shareholder means that you are invested in HCB and it is in your interest to follow the growth and success of the company. As the company grows so does the value of your shares.

In addition, you have the right to:

- Participate in, and vote at Annual General Meetings (AGMs) of the General Assembly (each share corresponds to 1 vote)

- Receive a share of the profits in the form of dividends

- Receive regular information regarding the company

How will HCB use my invested money / the proceeds from the IPO?

The proceeds from the IPO will be used to finance the operational and investment activities of HCB to increase the reliability of its operations, expand and diversify the business and to ensure the company's sustainability in the medium and long-term.

How will HCB communicate with me and how will I communicate with HCB

HCB will post relevant information to shareholders to the address provided at registration, and you will also receive regular BVM updates as per the stock exchange’s rules. In addition, you can contact HCB.

Will there be regular updates about shares to shareholders?

HCB will post relevant information to shareholders to the address provided at registration, and you will also receive regular BVM updates as per the stock exchange’s rules. In addition, you can contact HCB.

Will there be any restriction to trade my shares?

Applicable stock exchange rules will apply to all shareholders. Eligibility criteria will need to be met by any potential buyer.

Will the shares be transferable to my beneficiaries in the event of death?

Shares will be transferred to nominated beneficiaries, subject to the eligibility criteria and applicable sanction.

May I pledge or use my HCB shares as a form of security?

Participants are entitled to use their shares as they want provided the pledge is with Mozambican citizens or qualifying companies.

Can I nominate someone to the Board of HCB?

If you hold at least 5% of the shares you will have a say in the appointment of a Secretary and members of the Fiscal Council and will also be able to request the convening of extraordinary meetings (under the terms established in the Statutes).

Can I buy shares on behalf of other people or relatives?

Shares can be bought on behalf of other qualifying persons, and all rights and dividends shall rest with those persons.

How will I get my money back if HCB doesn’t make a profit to distribute to shareholders?

HCB has a strong track record of delivering shareholder returns, distributing up to 50% of its net profits to shareholders. However, if you are not satisfied with the returns received or the performance of the company, you will be able to sell your shares on the BVM through a financial intermediary. Depending on the price of the share at that point in time and after the costs involved in the sale of the shares you will either realise a profit or a loss.